April 7, 2025

In a season of renewed tariff pressure, outdoor brands with global supply chains are again facing a familiar dilemma: how to adjust pricing quickly, strategically, and credibly. New Trump-era tariffs—building on preexisting duties—are hitting margins hard, and brands have little time to react.

For companies with broad portfolios—say, apparel, accessories, and equipment—the challenge isn’t just about passing along cost increases. It’s about managing a mixed-margin portfolio, anticipating competitor behavior, understanding consumer psychology, and acting with timeliness amid pressure from retail partners.

Let’s walk through those dynamics, one at a time.

1. Managing a Mixed-Margin Portfolio

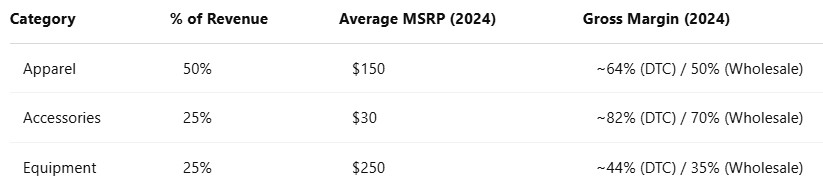

Margins vary widely across categories. Here’s a representative picture for an outdoor brand with $200M in annual revenue and three major product lines:

2. Anticipating Competitor Behavior

Brands operating across multiple categories must think differently than single-category specialists. A one-size-fits-all pricing response can unintentionally create openings for category-focused competitors.

Consider The North Face. As a broad portfolio brand spanning apparel, accessories, and equipment, it often finds itself competing with single-category specialists like Osprey or Gregory in the bags and packs space. These competitors tend to:

- Drive higher volumes in their focused category

- Maintain more diversified supply chains tailored to that category

- Operate at lower landed costs and higher efficiency

If a brand like The North Face applies a blanket price increase across its full assortment, it risks creating an opening—however small—for category specialists to gain share. That increase might be appropriate for apparel but too aggressive for equipment, where a competitor like Osprey has greater pricing resilience.

These dynamics complicate every pricing move. Competitor reactions aren’t uniform. Some will delay. Others will overcorrect. Some may act regionally. Every decision your brand makes becomes part of a high-stakes guessing game.

3. Understanding Consumer Psychology

Consumers are conditioned to buy at “magic” price points: $30, $35, $50, $75, $100.

When your pricing model says accessories need to move from $30 to $32.08 to maintain gross margin, you often face a no-win choice:

- Rounding down and holding at $30 means taking the cost increase and margin erosion on the chin

- Rounding up to $35 risks consumer rejection or pushback from retailers

- Leaving it at $32.08 (or rounding to $32.00) leads to awkward positioning and reduced perceived value

This problem is most acute at low price points.

“Lower-priced items often adhere to psychological pricing strategies… Deviations from these established price points can disrupt consumer expectations and deter purchases.” — NetSuite

Behavioral pricing research supports this: consumers show greater price sensitivity at low prices, where even small increases feel significant. A $5 increase on a $30 item feels weightier than a $25 increase on a $375 tent.

4. Acting Under Pressure from Retail Partners

Retailers expect their vendors to act quickly. As the last link in the value chain, they don’t want to be constantly adjusting assortment pricing as brands revise their price lists in waves.

While brands may be tempted to “wait and see” how competitors respond to tariffs, hesitation can erode retail confidence. Buyers juggle hundreds of SKUs and dozens of suppliers—they need clear, timely direction. Delaying your pricing updates can damage long-term relationships. Acting decisively can make you a hero.

Once you’re committed to a pricing strategy, the process unfolds in two parts:

Step 1: Choose Your Strategic Pricing Approach

Option 1: Blanket Price Increase Across All Categories

- Pros: Fast and easy to implement, Clean messaging to internal teams and retailers

- Cons: Can land you at odd price points. Can perpetuate problems with margin-challenged categories (in this case, equipment). Can be met with suspicion from retail partners who know brands have mixed-margin portfolios—and from sales teams who must deliver the news with a straight face. Encourages competitors with leaner cost structures to undercut selectively

Option 2: Targeted Price Adjustments (Variable % by Category or SKU)

- Pros: More credible with retailers—signals thoughtfulness and responsiveness. Allows for selective margin recovery where pressure is highest.

- Cons: Harder to execute across systems, sales materials, and retail partners. Can expose internal margin structure to your customers and competitors if not messaged carefully.

Step 2: Choose Your Executional Tactic

Once the strategic path is set, the next question is how to express your new pricing:

Option A: Use Odd/Exact Price Points

- Pros: Achieves margin recovery objectives with precision

- Cons: Often results in “uncomfortable” MSRPs like $32.00 or $151.00—awkward in retail and hard to communicate. Retailers may round up or down in violation of your pricing programs.

Option B: Round to Psychological Price Points (“Magic Numbers”)

- Pros: Matches shopper expectations and retail merchandising logic

- Cons: Can erode margin recovery, especially at low price points. Can unintentionally position your product a full tier above or below key competitors—regardless of actual value or differentiation.

Option C: Use a Tiered and Blended Approach

- Pros: Lets you round cleanly in high-ticket categories (where $25–$50 swings are tolerable) and preserve exactness in low-price accessories

- Cons: Requires more deliberate planning, clear communication, and strong cross-functional coordination

This is how it plays out in real-world pricing strategy:

- Step One: Your Internal Approach. Operationally and financially, decide between a blanket solution or a precise category-specific program.

- Step Two: Your External Execution. Decide whether you’re comfortable landing at $32.08, $32.00, or whether you’d rather round up to $35 and carry the consequences.

Conclusion

In 2025, pricing isn’t just a finance exercise—it’s a game of competitive signaling, retailer alignment, and psychological nuance. A thoughtful pricing strategy doesn’t just protect profit—it protects trust, positioning, and your long game in the marketplace.

Just don’t let your pricing story end at $32.08.